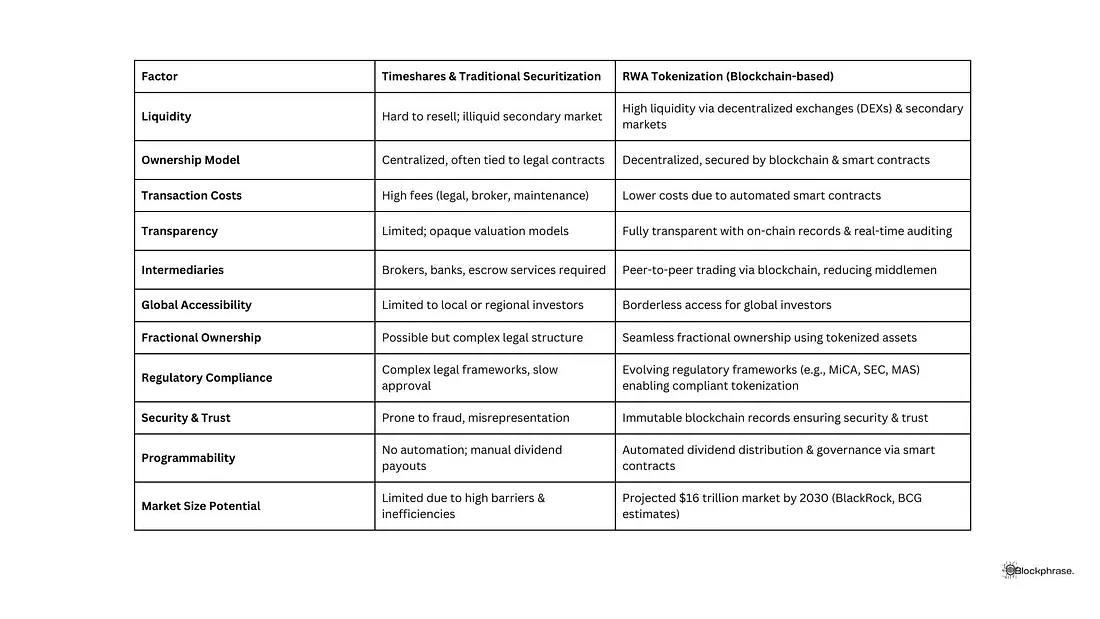

RWA Tokenization is touted as an upcoming 16 Trillion $ industry, but the crazy thing is that this concept has existed since the 1960s in the form of timeshares, however, timeshares did not pick up so well do the masses!

The major difference between RWA Tokenization & Timeshares is the Blockchain technology as it solves the problems that Timeshares failed to solve such as —

1. Illiquidity & Poor Resale Market — Timeshares had high entry & exit barriers with unclear ownership rights due to the lack of regulations for Asset-backed securities until 2008’s Subprime crisis

2. High Fees & Intermediaries — Timeshares require you to go through investment banks, custodians, and other long channels with heavy costs

3. Lack of Transparency & Fraud Risks — As I mentioned, until 2008 asset-backed securities had zero transparency and it was all a sham that burst

4. Limited Accessibility — Only large houses could access it, I mean what’s the point of fractionalizing an expensive asset when the retailers can’t even buy it?

Timeshares failed here! But 2008 was when regulations for Asset-backed securities kicked in and also the emergence of blockchain on the mainstream conversations

Blockchain solved all the problems that timeshares failed to and solved a few more problems that might arise and RWA tokenization kicked in!

1. Blockchain Enables Liquidity

Unlike timeshares, secondary markets (like DeFi lending and DEXs) create instant liquidity for RWA tokens.

2. Programmability & Smart Contracts

RWAs use smart contracts to automate dividend payments, ownership transfers, and compliance rules, which means. you do not need third parties reducing costs and increasing trust (Unless it’s built on a weird blockchain with poor infrastructure)

3. Lower Transaction Costs & Borderless Access

Blockchain-based tokenization reduces administrative costs and enables global participation as several processes are automated and this is only going to get better with AI

4. Regulatory Advancements & Institutional Adoption

Major financial institutions (BlackRock, JPMorgan) are now entering the space, legitimizing tokenized RWAs and the rise of compliant tokenization frameworks (MiCA, Hong Kong’s regulatory sandbox, etc.) ensures institutional trust.

5. Macroeconomic Factors Favoring Tokenization

Declining global interest rates and inflation concerns drive investors to alternative assets and similarly, real estate aims to solve its illiquidity problem.

RWA is one of the 2 real use case narratives that are going to boom in the world as well as the Web 3 Space!

So, if you need help with your RWA Tokenization, you can reach out to us at Info@blockphrase.com or Visit www.blockphrase.com