For most cryptocurrency projects, you’ve probably read the words “Inflationary token mechanisms” & “Deflationary Token mechanisms.” So when do you make your token inflationary or deflationary?

Now this ain’t the gospel of truth, but these are some scenarios when these “mechanisms” apply considering ceterius paribus

For Inflationary Token models

– If you’re project requires continuous rewards or incentives for your miners, Liquidity providers, or Dev Community. ($ETH, the synthetic utility stablecoin, is an example)

– M2E, P2E or Games need constant token issuance to reward players while maintaining engagement. A controlled inflation rate prevents early adopters from holding all the supply and dumping on the others like $LIBRA did a couple of days ago.

– In certain uncommon cases, projects like stablecoins or governance models need inflation to maintain supply-demand balance. (e.g., DAI’s dynamic minting)

Now for your deflationary token models –

– If your goal is to create a store-of-value asset, limited supply + burning mechanisms help keep tokens scarce over time. (Eg — Rollbit)

– When your tokenomics stress test or forecast displays that too many tokens in circulation may cause a price instability, introducing deflationary mechanics like buybacks or tax burns can help stabilize the market (Best to be prepared ahead with proper tokenomics than winging it once the token is live)

– Projects that generate transaction fees can burn a portion of tokens, Binance does this randomly, especially after they make profits on your liquidations.

There are a lot of tokens that use the wrong approach in the terms of inflationary model or deflationary model, end up shooting themselves in the foot.

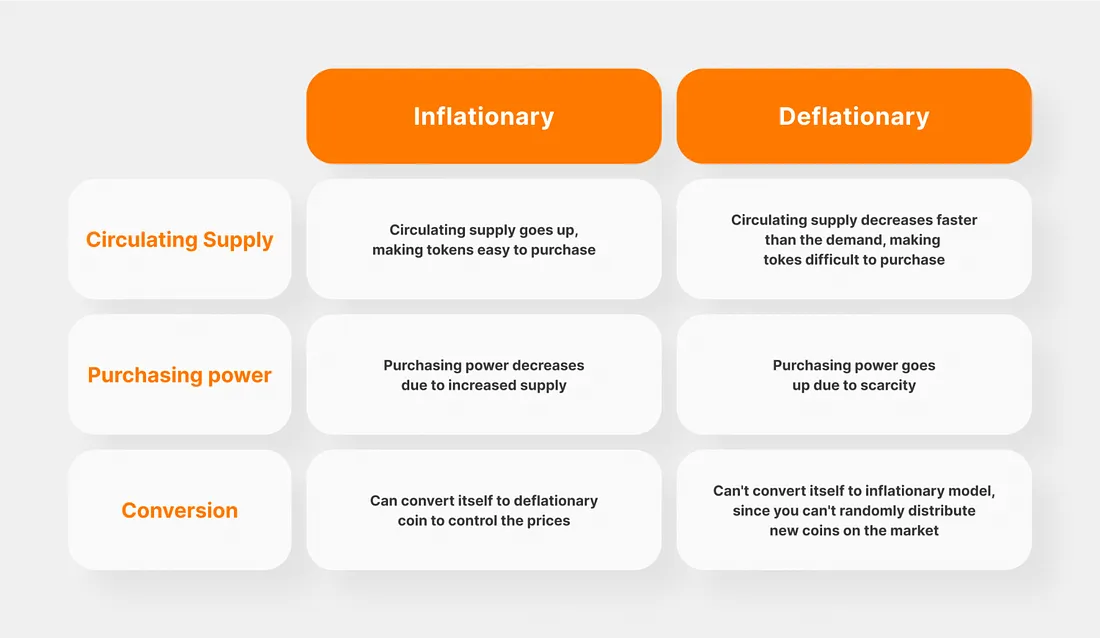

Here’s an image of the basics of inflation vs deflation

If you need help with your tokenomics, reach out to me or visit www.blockphrase.com to know more!

#Crypto #Web3 #Tokenomics #Blockchain #Cryptocurrency #Bitcoin #Inflation #Economics